Spanish vs Portuguese interest rates: which are most competitive?

Quick overview: Explore the latest Spanish and Portuguese mortgage rates and compare them.

There’s no one-size-fits-all secret to finding the perfect mortgage, whether in Spain or Portugal. Some prefer a fixed rate for stability over the years, while others, more risk-averse, opt for a variable rate.

The first step to understanding which mortgage is a good fit for you is to assess your financial situation—we can work together to optimize your mortgage experience.

Which country has the most competitive rates? Let's explore the options together and find the right answer for your profile.

Spain's interest rates experienced a slight decrease in April

The average interest rate in Spain was 4.27% in April, a continued decline from 4.91% at the beginning of the year. Banks continue to make more competitive offers, and the average wait time is ten days, a bit longer than the previous month.

Variable, fixed, and mixed mortgage rates in Spain for non-residents decreased slightly in April.

According to data collected from mortgage offers that Homevest users received last month, Cajasur had a fixed interest rate of 3.65%, making it the most competitive among Spanish banks.

Portugal’s interest rates have decreased for the first time in two years

The average interest rate, currently at 4.64%, reflects this decline from the beginning of 2024. As per the National Statistics Institute, the interest rate on housing has decreased for the first time since March 2022.

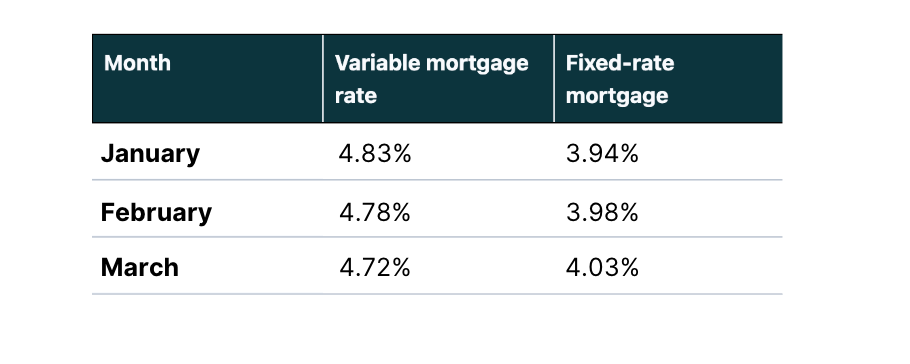

This decrease applies equally to both variable and fixed mortgage rates.

In Portugal, mortgage rates are identical for residents and non-residents, potentially making them more attractive to buyers.

“Banks roll out new offers each week. What's best for one client might not suit another. It all comes down to each person's financial situation and needs,” says Reorganiza, Portugal's leading mortgage broker.

Best banks in Spain vs. Portugal

Obtaining a mortgage in Spain as a non-resident means up to 70% financing with a minimum 30% down payment and extra costs. The process is complex, with a 35% debt-to-income ratio limit and additional documentation.

EU non-resident applicants are eligible for an LTV ratio of 75%-80% when accessing a mortgage in Portugal with foreign income. At the same time, Portuguese citizens living abroad are eligible for an LTV ratio of 85%. The offer includes up to 30-year terms with a debt-to-income cap of 35%.

To help you form an opinion about the offering of the best mortgages in Spain vs. Portugal for non-residents, let's make a brief comparison:

The mortgage choice for your new home is yours, depending on your needs. Both countries offer the potential to generate rental income and are popular tourist destinations worldwide.